Brown Forman - All Time High

Jun. 1 2015, 5:23 PM ET - by VF member vanmeerten (903

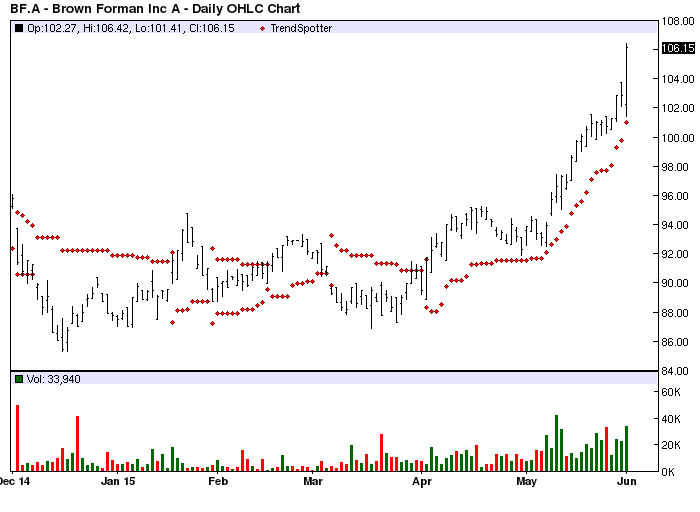

The Chart of the Day is Brown-Forman (BF.A). I found the stock by sorting the All Time High list

for the stocks with the highest technical buy signals then used the Flipchart feature to review the charts. Since the Trend spotter signaled a buy on 4/2 the stock gained 15.73%.

Brown-Forman Corporation is a producer and marketer of fine quality beverage alcohol brands. The brands include Jack Daniel's, Southern Comfort, Finlandia, Canadian Mist, Fetzer, Korbel, Gentleman Jack, el Jimador, Tequila Herradura, Sonoma-Cutrer, Chambord, Tuaca, Woodford Reserve, and Bonterra. They globally market and sell various categories of beverage alcohol products, such as Tennessee, Canadian, and Kentucky whiskies; Kentucky bourbons; California sparkling wine; tequila; table wine; liqueurs; vodka; and ready-to-drink products. They sell their wine and spirits brands either through wholesale distributors or in states that directly control alcohol sales, state governments that then sell to retail customers and consumers. Their main international markets are the U.K., Australia, Mexico, Poland, Germany, France, Spain, Italy, South Africa, China, Japan, Canada, and Russia.

The status of Barchart's Opinion trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com web site when you read this report.

Barchart technical indicators:

100% Barchart technical buy signals

Trend Spotter buy signal

Above its 20, 50 and 100 day moving averages

12 new highs and up 13.12% in the last month

Relative Strength Index 84.59%

Barchart computes a technical support level at 101.21

Recently traded at 106.15 with a 50 day moving average of 94.91

Fundamental factors:

Market Cap $22.37 billion

P/E 32.54

Dividend yield 1.23%

Revenue expected to grow 3.60% this year and decrease by 3.10% next year

Earnings estimated to increase 4.90% this year, an additional 7.80% next year and continue to increase at an annual rate of 7.50% for the next 5 years

Wall Street analysts issued 3 strong buy, 3 buy, 8 hold and 2 under perform recommendations on the stock

The technical trading strategies that were reliable caused excessive trading, so I'd advise you to use a stop loss 10% below the last previous high to protect your gains.

|

||||||||

| |

Brown Forman - All Time High